As Silver Scores a Nearly 14-Year High, New Records Could Be Just Around the Corner for Precious Metals

Comex silver futures (SIU25) scored a nearly 14-year high today of $39.85 an ounce as of this writing. Gold prices (GCQ25) today notched a five-week high of $3,451.00, basis August Comex futures. Especially impressive this week is that the two safe-haven metals are rallying at the same time as major U.S. stock indexes are hitting record highs and risk appetite in the general marketplace has ticked up. That’s a solid signal that more price upside in the two precious metals is likely in the near term.

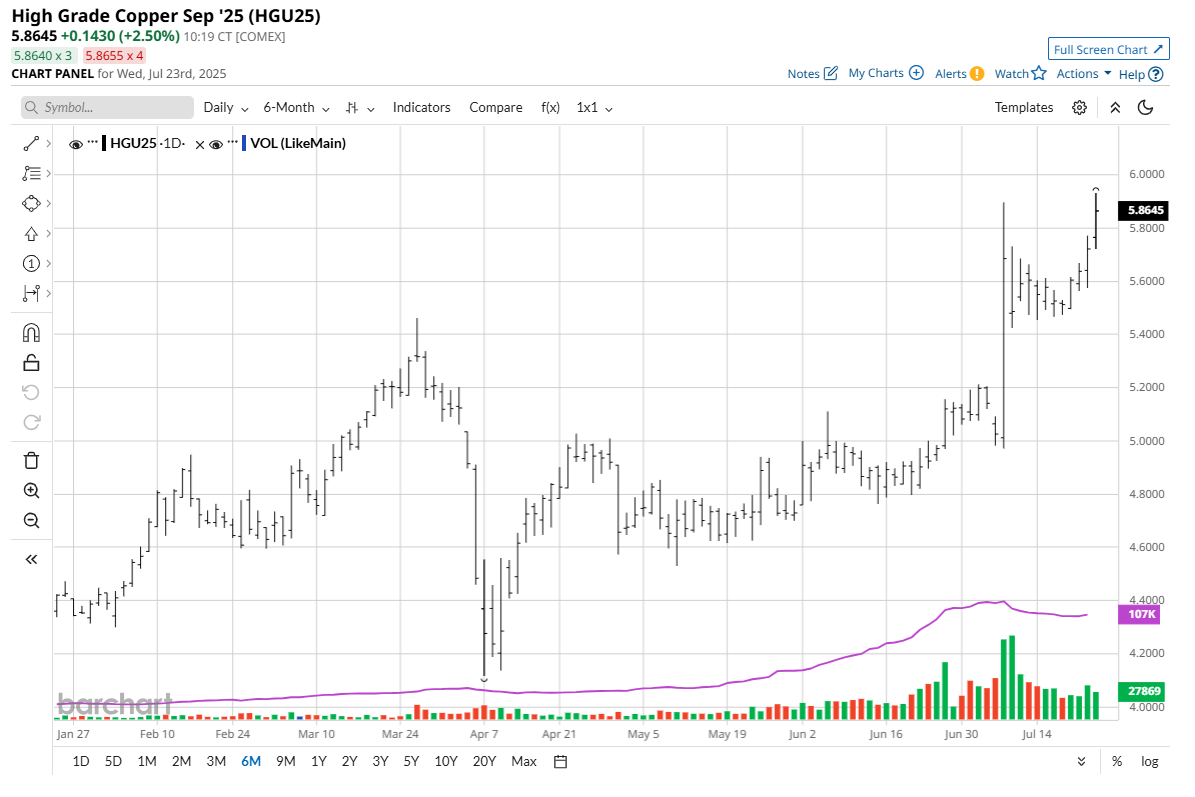

I suspect one reason the gold and silver markets are rallying despite less risk aversion in the marketplace is because of recent business media attention on soaring copper futures (HGU25) prices that this month hit a record high, as well as recent news that the U.S. and China are wanting to stock up on more rare earth metals and minerals.

My bias is that rallies in both the hard assets (metals) and the paper assets (stocks) cannot be sustained. Here’s a scenario that could play out in the coming weeks or months:

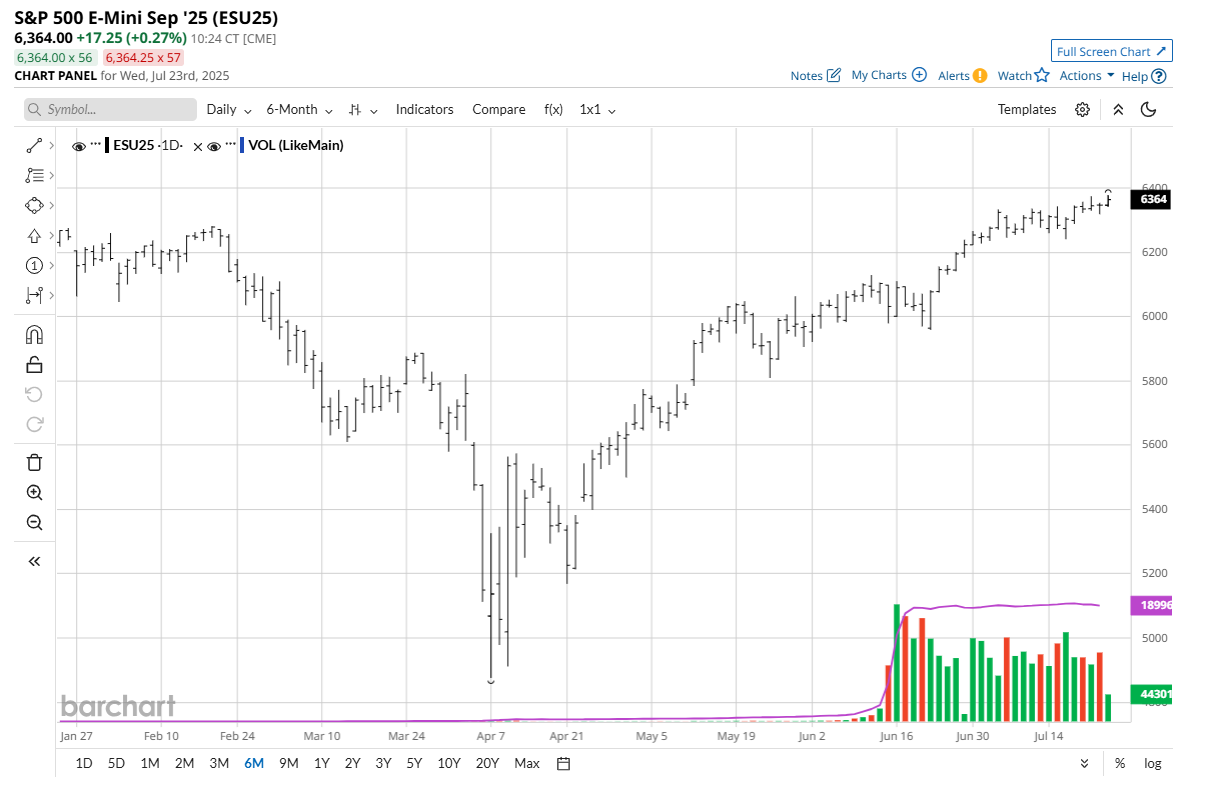

With the major U.S. stock indexes hitting record highs this week, it would not surprise me to see the stock indexes now trade sideways, or maybe just a bit higher, into the Labor Day holiday weekend in early September.

Gold and silver prices may also move into more sideways and consolidative trading ranges in the coming weeks — but not before likely gaining further in the very near term. It is highly possible that gold and silver could set new record highs before the Labor Day holiday — and especially silver.

For perspective, the all-time high in Comex gold futures was scored in April 2025, at $3,485.60 an ounce. The all-time high in Comex silver futures occurred in December 1979, at $50.36 an ounce. The fact that gold hit a record high in April, while silver is still more than $10 away from its record high, suggests that silver has more room to run on the upside in the near term, compared to gold.

My bias is that silver is still a value-buying opportunity even though prices hit a nearly 14-year high today.

After the U.S. Labor Day Holiday…

The Labor Day holiday in early September marks the unofficial end of summer for Americans. Summer vacations are over, kids are back in school, days are getting shorter and cooler, Europeans are back from their August break — and traders and investors are getting back to business following the summer doldrums.

History shows the months of September and October can be very unkind to stock market bulls. That may especially be the case this year, since the U.S. stock indexes hit record highs over the summer.

It seems that in the fall, traders and investors become more worried about things, which this year will likely include an overbought stock market, global trade tensions, government debt problems, and geopolitics.

If the U.S. stock markets start to wobble this fall, which I think will be the case, then global stock markets will likely also become shaky. To extrapolate further, currency markets may then also become more volatile as government debt worries may increase. This scenario is bullish for the safe-haven gold and silver markets.

Other fundamental elements that are likely to work in favor of the gold and silver markets bulls in the coming weeks and months include:

- Geopolitics, which have the potential to come to a boil rapidly and become a front-burner issue. The Middle East remains a potential powder keg. Russia-U.S. relations are strained at present. The Aug. 1 U.S. tariff deadline is rapidly approaching, and the U.S. and European Union have not come to an agreement.

- Technical charts for gold and silver remain overall bullish from both shorter-term and longer-term perspectives. That’s going to keep chart-based traders and investors playing the long side of the metals.

- Upbeat economic data coming from the U.S. and China means likely better consumer and commercial demand for precious metals, especially from China.

To my valued Barchart readers: Enjoy the rest of your summer but then buckle up for some turbulence after Labor Day.

Tell me what you think. I really enjoy getting email from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.